Financial Education Can Be Fun For Everyone

Wiki Article

Some Known Facts About Financial Education.

Table of ContentsAbout Financial EducationIndicators on Financial Education You Should KnowGetting My Financial Education To Work6 Simple Techniques For Financial EducationRumored Buzz on Financial Education

So don't be afraid! As your youngsters get older, share your individual experiences and also the cash lessons you discovered, for better or for worse. If you have actually had problems staying with a budget plan or entered into credit-card financial debt, be honest with your teenager about your errors so they can pick up from your experience.While the info provided is believed to be factual and present, its accuracy is not guaranteed and also it must not be considered a full evaluation of the subjects discussed. All expressions of point of view show the judgment of the author(s) since the day of magazine and also undergo transform.

I can have learned a great deal regarding handling money. As I have actually additionally discovered, it's never also late to begin saving!.

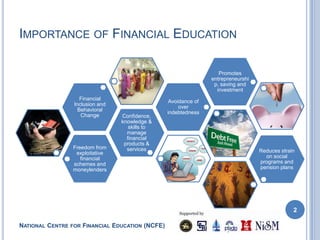

Financial savings prices are lowering while financial obligation is enhancing, as well as earnings are remaining stationary (Best Nursing Paper Writing Service). University student who prioritize economic proficiency will certainly be able to overcome these challenges and live conveniently in the future. Congress established up the Financial Literacy as well as Education Commission under the Fair as well as Accurate Debt Transactions Act of 2003.

Getting The Financial Education To Work

One important part of financial literacy is the capacity to gain cash. Even much more than that, it's about the understanding of what occurs to the money you make, including: The quantity you take house on your income The advantages your company uses The amount you pay in tax obligations and where that money goes It's particularly important that young individuals discover this concept of economic proficiency early before they sign up with the labor force.Conserving is among the most important means to plan for your financial future. It is just one of one of the most critical principles for youths to discover. This includes every little thing from just how to open up an interest-bearing account to exactly how to in fact save cash. A crucial component of this concept is to create the practice of savings.

Several young people get their very first part-time job in high college or university however then have no monetary duties. As a result, they can invest their money on enjoyable.

It likewise consists of the ability to live within your means and also make educated purchasing decisions. There's never ever a much better time to learn more about the monetary proficiency principle of borrowing than as a young individual. Well over half of students borrow cash to make it through university, and also the course of 2019 graduated with around $29,000 in student loan debt.

The Best Guide To Financial Education

It begins with learning concerning credit rating ratings and credit history records, which are some of the most crucial establishing variables when it comes to using for credit scores. As soon as somebody has developed up the monetary background to certify for car loans and also credit scores, it's vital that they understand their lending terms, such as APR.Concerning fifty percent of those with pupil lending financial debt regret their decision to borrow as much as they did.

Today, college-educated workers make roughly the like college-educated individuals did in previous generations, when you account for inflation. When you look at those with a partial university education and learning or none at all, today's young people are making much less than previous generations. Due to the fact that young individuals are earning less money, it's essential that they learn to manage it.

Financial Education Things To Know Before You Get This

If this pattern proceeds, it could be the case that today's young people make the same as and even less than their moms and dads as well as grandparents did. Financial proficiency is decreasing among young individuals at read the full info here once when it's much more essential than ever. As an university student, currently is the moment to locate ways to increase your understanding of monetary abilities and concepts.If it holds true that we're presently in an economic downturn, it's feasible that the supply market, in addition to income, might decrease, as firms earn less revenue as well as supply owners become a lot more risk-averse and want to various other properties to safeguard or expand their riches. This is one factor it can be so helpful to maintain a high degree of monetary proficiency.

This is one more reason to obtain carrying on your personal economic educationthe sooner you get the fundamentals down, the faster you can make enlightened choices. Better yet, the sooner you have the basics down, the faster you can increase your financial education additionally and gain much more insight into your one-of-a-kind economic circumstance.

In an economic climate where analysts are talking about whether or not an economic downturn has actually begun, now might be a blast to start learning, or you can look here find out much more, about personal financing, portfolio building, as well as diversity. In the previous year, we've put many hours of infiltrate making it easier than ever before to accessibility our huge collection of article, unique records, video clips, as well as a lot more.

Little Known Facts About Financial Education.

To get more information regarding the protective power of precious metals, VISIT THIS SITE to ask for a FREE copy of our Gold Info Package.

This is other so since kids have a really precious gift: time. The future benefits are bigger the earlier your youngster begins spending money. Since cash is made each year from the revenues of the previous year, this is the outcome of the magic of compounding, which results in the increase of gains with the addition of passion to a principal sum of the down payment.

What economic education lessons can we provide young individuals that only have access to a couple of figures on a display for cash? Exactly how can we introduce them to the relevance of economic literacy? Presenting our deliberate cash discussions and also expectations will certainly prepare your teenager for their adult years by equipping them with the experience and knowledge they need to secure their finances and also prevent pricey blunders.

Report this wiki page